About

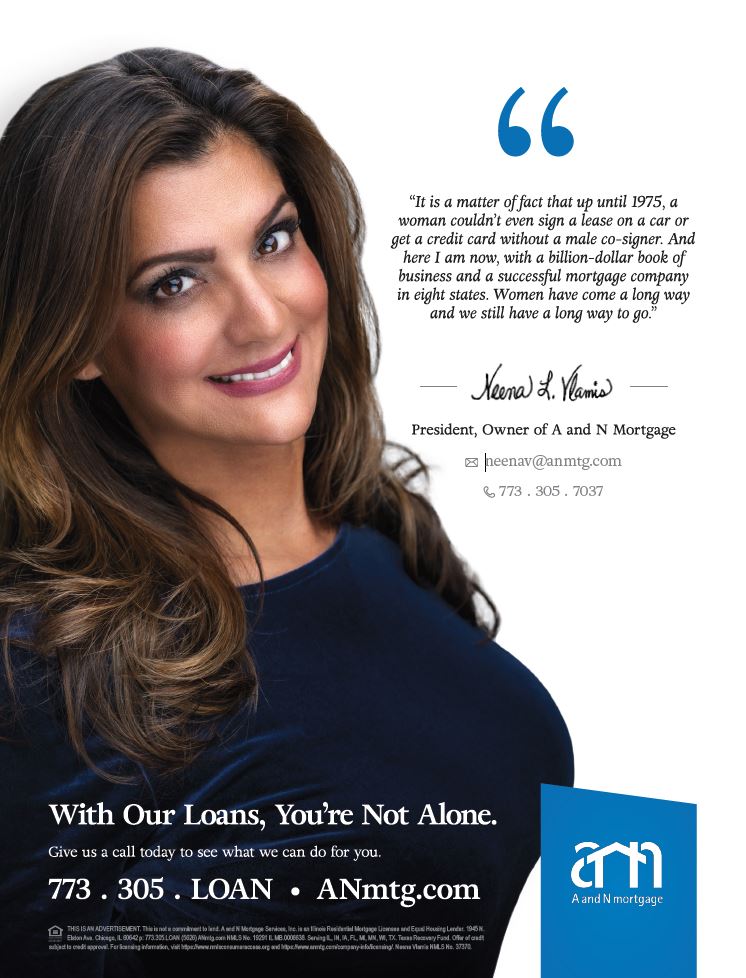

Hi, I’m Neena Vlamis and I am the President and Owner of A and N Mortgage. I have ranked in the Top 200 per Scotsman Guide Magazine for many years in a row and have been a Five Star winner consecutively for the last thirteen years. My razor-sharp focus has led the company to an A+ Better Business Bureau rating since its inception.

I like to think of myself as an inveterate problem solver with a passion for home mortgages. Whether patiently guiding clients through the mortgage process, educating my real estate partners about new products, or being a financially savvy mother to my children, I thrive on finding the perfect mortgage product for each client’s financial circumstance and helping my team to do the same.

Latest Blogs

Spring into Action: Boosting Curb Appeal for a Successful Home Sale

Apr 1, 2024

As the flowers bloom and the days get longer, the real estate market is buzzing with activity. The spring season is renowned for being one o..

Read More

Demystifying Your Mortgage Payment: A Comprehensive Guide for New Homeowners

Apr 1, 2024

Becoming a homeowner is an exciting milestone, and understanding the components of your mortgage payment is crucial for a smooth financial j..

Read MoreFeatured Press

Dynamic Women

Teaching and supporting female leaders.

Top Real Estate Leaders Mar 22

Educating females on financial freedom.

Visionary Mortgage Leader

A visionary leader with a focused mindset.

Empowering Women

Female leaders overcoming challenges.

Inspiring Women

Giving back to make a difference.

Redfin Top Mortgage Expert

A and N Mortgage was named a top mortgage expert by Redfin. Check out the article we were featured in.