About

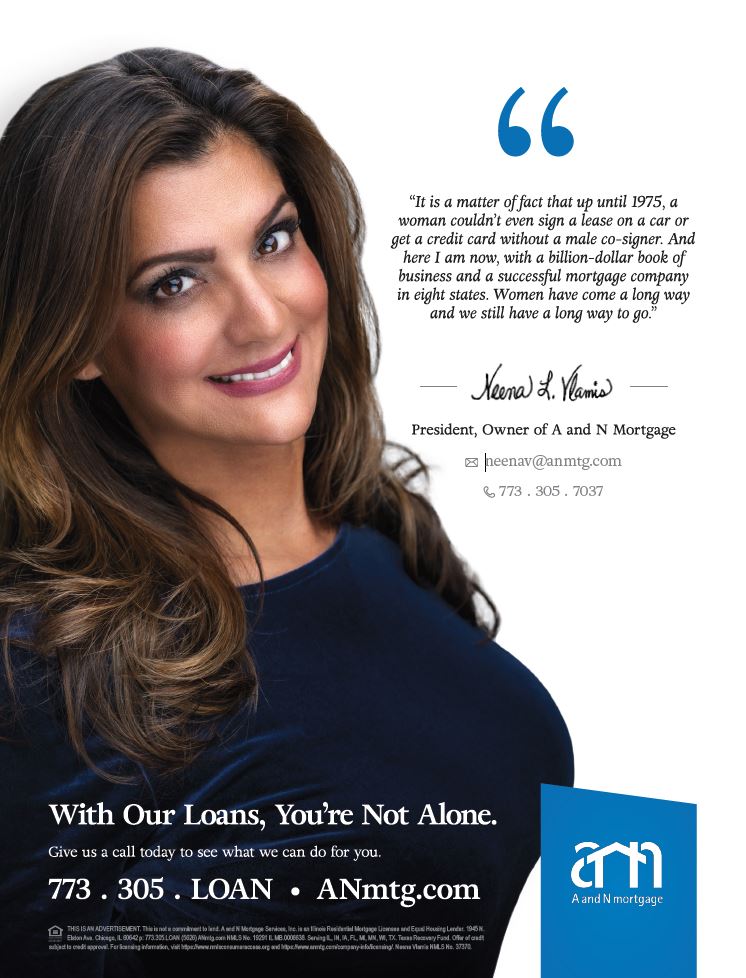

Hi, I’m Neena Vlamis and I am the President and Owner of A and N Mortgage. I have ranked in the Top 200 per Scotsman Guide Magazine for many years in a row and have been a Five Star winner consecutively for the last thirteen years. My razor-sharp focus has led the company to an A+ Better Business Bureau rating since its inception.

I like to think of myself as an inveterate problem solver with a passion for home mortgages. Whether patiently guiding clients through the mortgage process, educating my real estate partners about new products, or being a financially savvy mother to my children, I thrive on finding the perfect mortgage product for each client’s financial circumstance and helping my team to do the same.

Latest Blogs

Mortgage Refinance Alert: A Drop In 30-Year Fixed Refinance

Jul 26, 2024

To battle rising inflation, higher loan interest rates have become the norm. For homeowners to secure a mortgage with a high interest rate, ..

Read More

Understanding Home Equity: Everything You Need to Know

Jul 1, 2024

As a homeowner, one of your most valuable financial assets is the equity you build in your home. But what exactly is home equity, and how ca..

Read MoreFeatured Press

Dynamic Women

Teaching and supporting female leaders.

Top Real Estate Leaders Mar 22

Educating females on financial freedom.

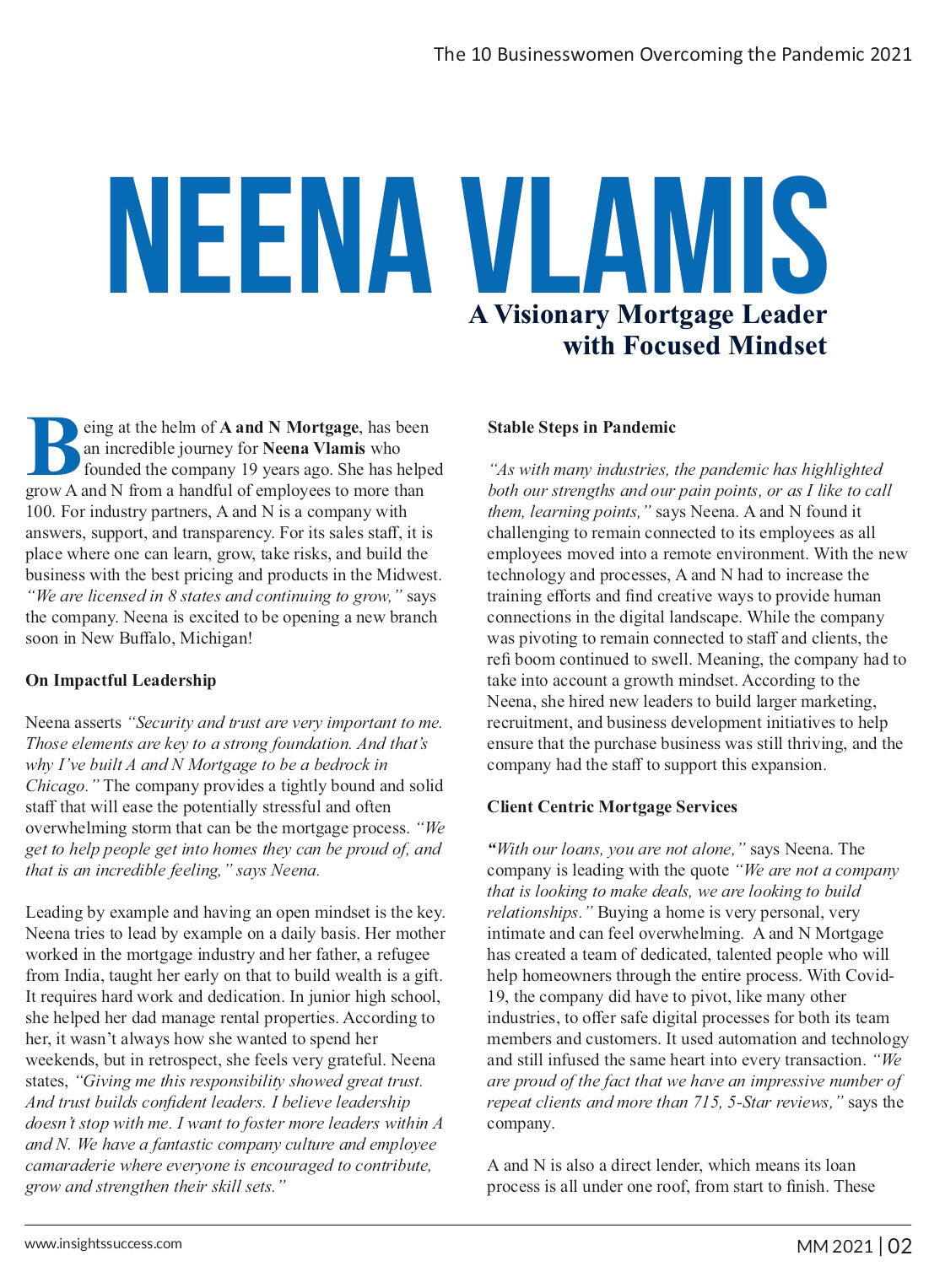

Visionary Mortgage Leader

A visionary leader with a focused mindset.

Empowering Women

Female leaders overcoming challenges.

Inspiring Women

Giving back to make a difference.

Redfin Top Mortgage Expert

A and N Mortgage was named a top mortgage expert by Redfin. Check out the article we were featured in.