As you approach the home buying process, you may be inclined to start by looking at houses in your desired location or getting in touch with a realtor. To make the process of buying a new home more convenient, however, you should actually start by obtaining mortgage pre-approval. Starting from here will save you time and energy in addition to helping you narrow down what you can afford from the start.

What is a Mortgage Pre-Approval?

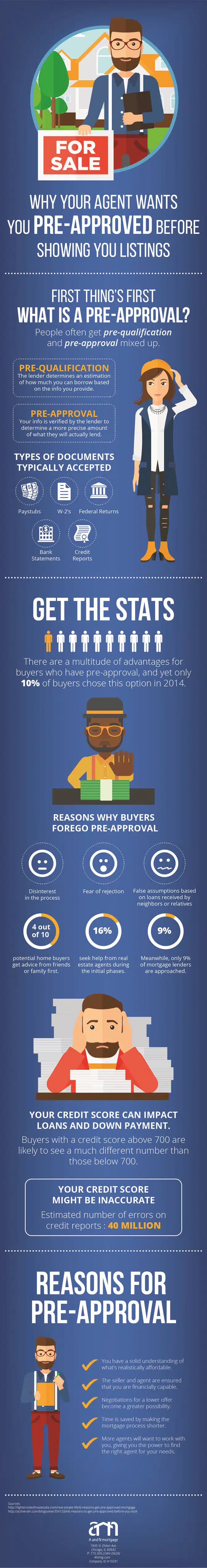

By consulting with a mortgage banker, you can often determine your mortgage pre-

approval in as little as an hour, if you have all of the required documentation handy. It is an application for credit that gives you a pre-approval mortgage in principle. You’ll get a loan amount that you are likely eligible for and terms that you can expect to receive when you apply.

You’ll be given a quick approval or denial with any conditions before moving forward in your home search. Though a pre-approval is not guaranteed (your financial situation may change, interest rates may go up or down, etc.), it is a pretty reliable estimate of how much you can expect to get for a mortgage and what your terms might look like.

What are the benefits of pre-approval?

Know where you stand

Pre-approval lets you know, without expending a lot of effort, where you stand with a potential lender. Your pre-approval will tell you how much the lender is willing to let you borrow, which will influence the properties you can buy. You can sift through properties confidently, knowing what your realistic price range will be.

Get Financial Clarity

One of the most significant benefits of pre-approval is that it gives you incredible financial clarity. Rather than making guesses about your financial state, you’ll have precise answers by going through the pre-approval process.

Regardless of whether you think that your finances are in good shape or not, you’ll have a pretty good idea once you’ve gone through the pre-approval process.

You’ll find out what your credit score is, see what you’ll be expected to come up with for a down payment, and take a good look at what your debt-to-income (DTI) ratio is.

If it brings to light some improvements that you need to make, you’ll have a better idea of what to work on to prepare better to obtain the best deal on a mortgage in the future.

Knowing what’s on your credit report might be the first step in working to bring up your credit score. Or if saving for a larger down payment gets you a better deal, you’ll find that out, too.

Your mortgage pre-approval results might also be the green light that you needed to move forward in the home buying process with confidence, armed with new knowledge of the actual budget for a house that you can afford.

People often find that lenders approve them for more than they expect. Taking that into account with what you can look forward to as monthly payments and closing costs will be the best way to move forward with your search for a new home.

Narrow Your Search

We all love to scroll through real estate listings, looking for properties in desirable neighborhoods, or gawking at the décor in elaborate, sprawling homes.

Without a pre-approval, you’re essentially window-shopping without knowing how much you can spend on a new home, so spare yourself the agony.

Without accurate pre-approval information, it isn’t easy to guess with any degree of precision whether you can afford a nicer property than you thought or to know that you need to trim your budget to better suit what you can afford.

Either way, a pre-approval gives you the information you need to target your search toward homes in your price range.

Prepare For Incidentals

There are a lot of different elements that comprise the final cost of buying a home. Things like HOA fees, property taxes, closing costs, and other fees may be part of your future financial responsibility.

Getting pre-approved lets you know what you have to work with as far as your likely future mortgage is concerned. This information gives you a concrete price range of properties that you can afford and whether your lender will loan you that much to complete the purchase.

Pre-approval can save you time and frustration by narrowing your search from the start. You know exactly what to look for as you start looking for properties with your realtor to avoid potential heartbreak or missing out on better opportunities.

Bid With Confidence

Today’s housing market is extremely competitive. The current low-interest-rate environment and reduced inventory on the market often mean that houses will sell relatively quickly, in some areas within hours of being listed.

Having a pre-approval will help you stand out in a seller’s market. Apart from being a cash buyer, having your pre-approval in hand is the next best thing. It shows that you are fully funded and prepared to buy this home at this price right now.

When you submit an offer on the home that you’re ready to buy, indicating that you have your financing in order and are prepared to move forward to close quickly can make all of the difference to a seller.

Offers with pre-approval almost always carry more weight than comparable offers from interested parties who aren’t pre-approved. It is not unheard of for a seller to choose a marginally lower bid with pre-approved financing because the buyer with pre-approval is ready to go to closing.

If a seller decides to counter your initial offer or you find yourself in a bidding war, you know your parameters.

Again, this takes a bit of anxiety out of the purchase process because you’ll learn how high you can without exceeding your budget. To successfully negotiate, you have to know what you can put on the table.

Sail through the formal application and purchasing process. Once you’ve found a home, the formal loan approval process should be smoother and allow you to close in less time since you have all of the important information close at hand.

Accurately anticipate costs

Going through the pre-approval process will save you a lot of guesswork. You’ll know what to expect your monthly payment will be, anticipate how much you need to cover for a down payment and estimate closing costs.

Lock in at a great rate

All of this information helps you prepare for the actual mortgage application and closing process, potentially saving you a lot of time and frustration. Better still, pre-approval mortgages provide rates that are good for three to four months. If interest rates are expected to increase, consider securing a better rate with a pre-approval.

How Do You Apply Online for Mortgage Pre-approval?

Potential lenders can provide access to a secure online portal or use email and telephone to collect the required documentation to determine what you are approved for. You’ll need to provide proof of income, like W-2s and bank statements. You’ll also authorize your lender to pull a credit report, which may impact your credit report.

Your credit report will show that your credit was pulled and whether you were approved, denied, or chose not to go through with financing for the next five years. Be prepared to explain multiple inquiries if asked. Know that your credit score might take a hit if you seek pre-approval from several different lenders, especially if you are denied. In addition to your credit report, make sure you can check off the other items on this basic pre-approval checklist.

If you have these handy, you’ll breeze through the pre-approval process:

- Identification: items that prove you are who you claim to be.

- Bank account and investment statements: to show that you have enough income to make your monthly payments.

- Proof of assets: verify whether you own a car or boat.

- Proof of income: A letter from your employer or recent pay stubs to show regular income. Self-employed individuals may be subject to additional verification.

- Debt information: recent statements from your student loans, car loans, credit cards, and other outstanding liabilities. Disclose everything because lenders will verify this information, and it looks bad if you try to hide anything.

Dos and Don’ts of the Pre-approval process:

Pre-approval Dos:

- Consult with a mortgage banker. A mortgage banker is often a great first stop on your journey to mortgage pre-approval. They can guide you through the process of obtaining a pre-approval and help you find the best solution for your situation. A banker can help you work through a mortgage pre-approval checklist by obtaining a credit report without negatively impacting your credit score to prepare you and your application to your lender.

Since a mortgage banker acts on your behalf and with your best interests in mind, they can help you find the best mortgage product and ensure that you meet a lender’s policy requirements so that there are no surprises when you close. They’ll also be able to give you accurate calculations to assess how much you can borrow and repay based on your position. When it comes time to process your mortgage, they can help ensure proper processing and present your pre-approval package to the lender that you choose. All of this focuses your efforts and saves you time. - Get pre-approved as your first step on the path to homeownership. Consult with a mortgage banker, and you can have your pre-approval in hand that same day if you have everything you need. Knowing how much you have to spend informs your choices and helps you shop more effectively.

- Get your documents in order. Your mortgage banker will tell you what documents your lender requires as part of the pre-approval checklist.

- Read the fine print. Your loan officer will send you a pre-approval document. It’ll show the interest rate you’ll get, the terms of the loan, and that you’re pre-approved for. Make sure that you understand these terms, so ask all of the questions that you need to. Small changes, like fractions of percentage points, can have significant implications on your future monthly payments, so take your time.

Pre-Approval Don’ts

- Don’t get pre-approved for more than you can afford. You may be pre-approved for a larger amount than you need, but make sure that you can comfortably cover the monthly payments. Getting in over your head at this early stage isn’t smart.

- Don’t do anything that will significantly impact your credit after you’ve been pre-approved. A pre-approval isn’t guaranteed, especially if you do anything that shows you as an increased credit risk. Hold off on major purchases, like a new car until you’ve finalized your mortgage. Doing something like that can increase your debt-to-income ratio, and hurt your approval chances or increase your rate. Don’t apply for any new credit, either. Taking out a personal loan or new credit card, or co-signing a loan can have the same impact on your credit profile and jeopardize your pre-approval.

- Don’t quit or change your job after your pre-approval. Lenders need to see reliable income to ensure that you can service your monthly payments, so stay put until your mortgage is closed. If you lose your job, wait until you can prove steady income to apply, or you’ll risk rejection. Similarly, becoming self-employed as you’re going through this process complicates it significantly. It is best to hold off on making these significant changes since it’s such a vital part of any successful mortgage application.

Are There Downsides to Pre-approved Mortgages?

Expiry Date

Mortgage pre-approvals set a validity period according to the lender’s policies. If the period lapses, you will need a new pre-approval letter to start the process again.

Credit Score Effect

After the lender’s ‘hard credit check,’ a credit score may decrease. However, this is a temporary dip and only affects immediate borrowing activities.

No Guarantees

Both the borrower’s financial ability and the lender’s interest rates are bound to change—pre-approval does not sign the mortgage into existence at the same rates as when it first came on offer. Ask questions, and read the fine print.

The home-buying journey can be challenging, and experienced mortgage experts like the team at A and N Mortgage make the process simpler to navigate and give great advice.

Contact A and N Mortgage For Professional Advice

Start your home search by going through the pre-approval mortgage process before you start looking at houses. There are plenty of benefits to choosing to go through this simple, straightforward process. Find a mortgage banker or lender to help you organize your pre-approval package. They’ll review your documents, check your credit score and let you know how much you can expect to be approved and what terms you can look forward to.

This information will help you choose homes that you can comfortably afford, knowing that you are already well on your way to financing the home of your dreams. It will speed up the formal application process, help you get your down payment and closing costs ready, and assist you when you go to make an offer. Having a pre-approval makes sellers take you more seriously and is well worth the time to make your efforts more efficient.

Pay attention to these tips to ensure that your pre-approval is the best deal you can get and successfully complete the mortgage loan process. Following these suggestions will help you get pre-approved quickly to find and finance your new home with ease. Contact A and N Mortgage today to speak with a knowledgeable mortgage consultant!

A and N Mortgage Services Inc, a mortgage banker in Chicago, IL provides you with high-quality home loan programs, including FHA home loans, tailored to fit your unique situation with some of the most competitive rates in the nation. Whether you are a first-time homebuyer, relocating to a new job, or buying an investment property, our expert team will help you use your new mortgage as a smart financial tool.